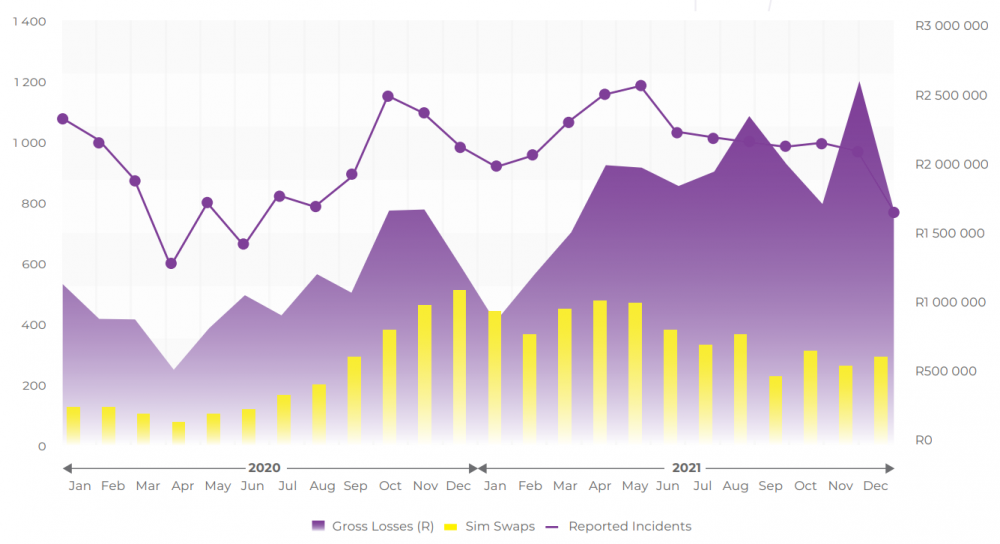

In its latest annual report for 2021, Snai said although the number of reported cases since 2020 has increased by 18% – the main mainly due to a decrease in frauds in mobile banking – therein the gross loss increased significantly by 45%, from R310 million in 2020 to Rs 440 million the following year.

Criminals have used social engineering techniques to their advantage and are moving away from the well-known phishing scam to other important methods.

Such methods include hacking employees’ work emails, general email hacking, phishing and phishing – all of which have appeared more frequently in the banking fraud sector.

The biggest source of money for cybercriminals is the abuse of the fact that most people are now banking online.

Snai says that while online banking fraud accounts for only a small fraction of digital crime cases, it accounts for the second largest share of total losses. On average, the amount cheated from people is around Rs 33,781.

Snai notes the following types of scams and patterns:

________________________________________

Vishing

In the case of fishing, scammers call victims, impersonating a bank or service official, and use Social skills to manipulate victims into revealing confidential information. are in turn used to defraud them, Snai said.

________________________________________

Phishing

A scammer sends an email to a potential victim, encourages them to click a link in the email, then takes them to a fake website designed to look like a website Legitimate banking.

Snai said victims were then asked to verify or update their contact details or sensitive financial information. In some cases, according to Snai, scammers request access to the OTP or RVN needed to complete a fraudulent transaction.

________________________________________

SIM Card Swapping

SIM Card Swapping has become a popular method for criminals to scam victims by intercepting transaction verification tokens. Compared to the previous year, SIM swapping service increased by 63% margin.

Through an unsuspecting banking customer’s mobile service provider, criminals obtain things like disposable PINs (OTPs) and random verification numbers (RVNs) for them and then access them. access money or legitimate transactions.

________________________________________

Polishing

Polishing is similar to a traditional phishing scheme, but done through a cell phone. When people use mobile banking channels, scammers try to take advantage of them.

Instead of sending an email as in a scam scheme, they send a text message to a potential victim asking them to call a number or click on a link then trick them into revealing confidential banking information. their secret, Snai said.

________________________________________

For such scams, Snai urges bank customers to treat requests for private and confidential information suspiciously and to have full discretion when it comes to sharing such information. , if required, Snai said.